The focus in 2026 will be on sustaining the growth momentum despite challenges like tariffs and foreign fund selloff. Financial assets are expected to be driven by central bank actions and trade deal prospects in the first half of 2026 amid heightened volatility. So, what should your strategy be in the New Year? Partha Sinha & Mayur Shetty explain…

Stocks lose sheen, FD rates may not rise, is gold still an option?

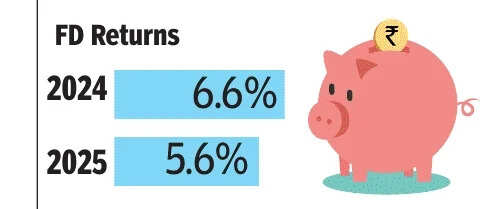

Losing interest in FDs?There’s not much leeway for banks to cut interest rates from the current levels. While credit offtake is showing good traction, deposit mobilizations are in the slow lane. In such a situation, it’s unlikely banks will cut FD rates aggressively. This could be good news for those who prefer the relative safety of FDs and are due to rollover their funds.

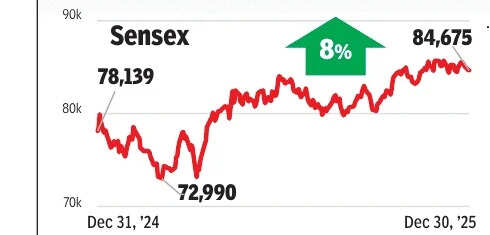

Stock up with caution in new yearLeading indices could remain fence-sitters in early months of the year. Signs of a turnaround in corporate numbers and strong domestic flows are expected to push benchmark indices higher. However, limited progress on India-US trade deal, geopolitical uncertainties, foreign fund selling and the weak rupee would weigh on equities.

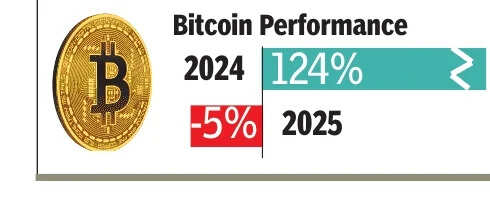

crypto conundrumIf 2025 was a watershed year for crypto, with most major economies tilting heavily in favor of these digital assets, 2026 could see gains, building off the developments of the previous year. Institutional demand for cryptocurrencies could rise

Gold & silver: Going up, up, upAfter two years of record-breaking gains, the two precious metals are unlikely to see any meaningful corrections. Geopolitical tensions, an uncertain global market, investment demand and especially for silver, rising industrial demand amid uncertain supplies, are seen combining to keep prices of these precious metals at elevated levels.

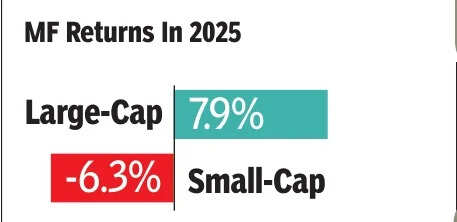

Mutual funds: Your long-term betIf we extrapolate the 20% CAGR for the industry’s AUM of the last decade into next year, 2026 should turn out to be the landmark year when the fund industry would cross the $1tn AUM mark. Also expect the growth of passive funds to continue to surpass the same for actively managed ones.

Bond with bonds?A section of the market is apprehensive about govt’s gross borrowing program for FY27, given the sizable redemptions during the year. Since the economy is near the end of the rate easing cycle, higher gross borrowing may distort the demand-supply dynamics. Bond yields could rise. RBI recently announced open market operations (OMOs) to cap any unfavorable spike in yields. More OMOs may follow in the next year(Source: ETIG, Value Research, SBI)

RBI focus on curbing cybercrime, insurance sector set for registration

Fight against fraud: Banks will have to obtain explicit customer opt-in for internet/mobile/USSD/SMS banking before starting digital services. Banks must also record consent, send real-time alerts, strengthen risk controls and cybersecurity. The intent is to cut fraud and ensure customers clearly understand which digital services are enabled on their accounts.No fee on no-frills bank accounts: Basic savings bank deposit accounts go completely free. Banks must offer zero-charge digital banking, cash deposits, ATM/debit cards and statements. The push widens inclusion and turns no-frills accounts into daily-use walletsRBI’s cybersecurity mantra: Banks must file core-banking ring-fencing plans, isolating critical systems from peripheral apps with a March 2028 deadline for full roll out. This segregation is meant to limit the impact of cyber incidents and system failures. Besides this roadmap, RBI is tightening expectations around how critical banking infrastructure is protected and monitored.More checks for e-payments: Digital payments face tougher gates. Banks must add two-factor/risk-based checks, layering biometrics or analytics over OTPs. At the same time, RBI is making digital deposits costlier for banks by raising liquidity buffer requirements, including an additional 2.5% run-off under the liquidity coverage ratio and tougher haircuts on liquid assets.Policy shift: Insurance rules set for reset under regulator Irdai. Insurers will shift from solvency-led capital to risk-based capital and adopt Ind AS 117, spreading revenue over policy life.Privacy please: Compliance tightens across banking and financial services sector. The Digital Personal Data Protection Act enforces encryption, access controls, audits, breach reporting and data officers, with penalties up to Rs 250 crore. Besides, telecom regulator Trai mandates a shift to 1600-series service numbers, with large NBFCs/payment banks due by Feb 2026, to choke spoofed calls and cut fraud at source.Insurance consolidation: A surge in M&A activity is expected in the insurance sector as the new law allowing 100% foreign direct investment is expected to take effect. The relaxation in norms pertaining to control and appointment of directors is expected to attract new players who had been waiting in the sidelines. Permission to acquire non-insurance cos is likely to lead to insurers acquiring insuretech and TPA firms