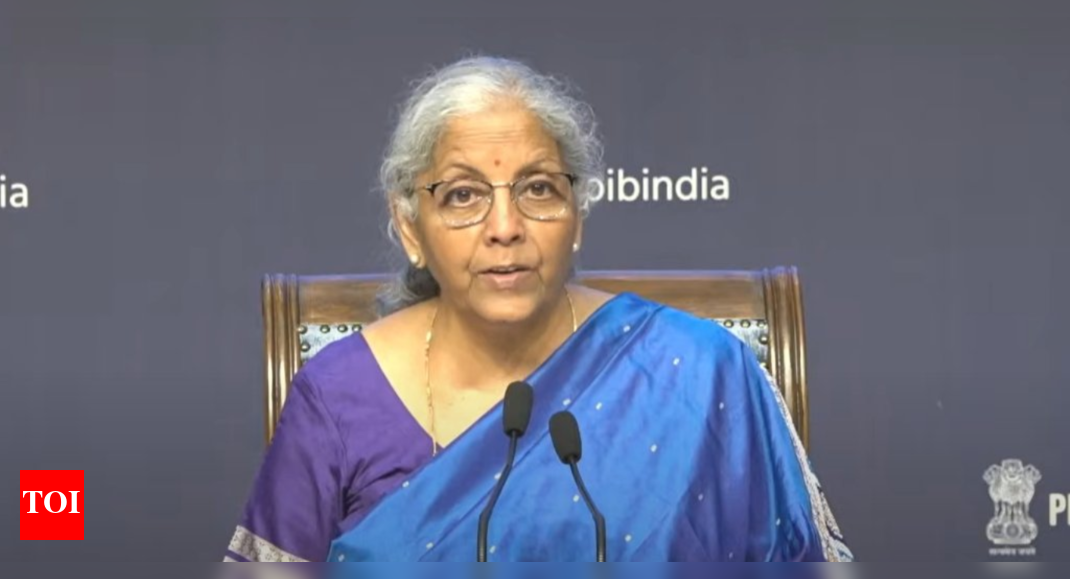

The GST Council on Wednsday Approved The Creation of a New Slab of 40% for Sin and Luxury Goods, Marking A Significant Change in the tax structure. While the date for its implementation will be announced later, the two other main slabs of 5% and 18% will come into effect from September 22.The highest slab of 40% will be levied on sin goods and premium items, include Large Vehicles, and Is Expected to Eventually replace the existing cess arrangement.Finance Minister Nirmala Sitharaman, Announcing Major Goods and Services Tax (GST) Rate Cuts, said the new two-tier system system would ease the Burden on the Common Man. “That special rate of 40% has also been proposed, and it’s been cleared and will apply only to paan masala, cigarets, gutka, cigarets, gutka, and other tobacco products in the first tobacco, Products LIKECOTS LIKECOCO, Products Unmanufactured tobacco, and bidi, “She said during the GST council meeting.She Further Added, “All Goods, Including Arated Waters Containing Added Sugar or other sweeting matter or flavored, caffeinated beVarages, Carbonated Beverages of fruit droverages of fruit droverages With Fruit Juice and other non-alcoholic beverages, Excluding that specified at lower rates, will all be covered under 40%. ““Under the GST, Till Such A Time The Loan is REPAID, AS I SAID, The 28% plus the compensation cess will run. On I clear the loan, they all come to 40%, and that’s whats is,” the fm said.Here is what will fall in the special 40% slab category:

- All Cars larger than 1,200 cc for petrol and 1,500 cc for diesel

- Motorcycles Exceding 350 cc

- Aircrafts, Helicopters for Personal Use, Yachts and other vessels for pleasure or sports

- Pan Masala, Tobacco, Gutka, Bidi etc.

- Aerated watters with added sugar or sweetening matter

- Flaboured beverages

- Caffeinated Beverages

The government’s new GST Framework has streamlined the system into three key tax slabs: 5%, 18% and 40% – by moving items out of the existing 12% and 28% brakets.Under the revised structure, most food and textile products will attract a uniform 5% GST, replacing the earlier varying rates. Everyday Household Appliances Such as Refrigerators, Large Television Sets and Air-Conditioners Will Now Fall under the 18% Slab, Resulting in Lower Taxation for Consumors.