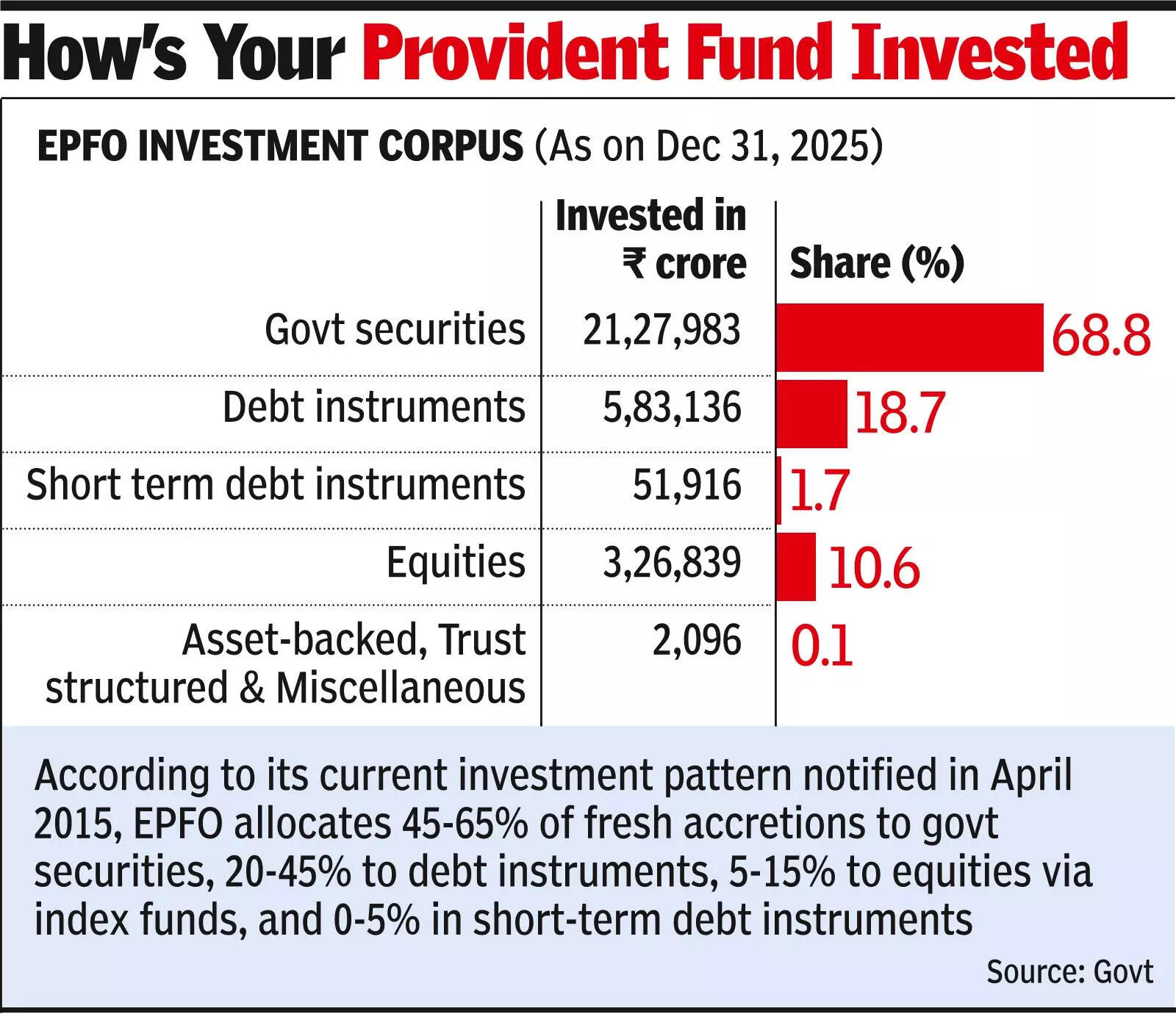

New Delhi: The Employees Provident Fund Organization (EPFO) is likely to constitute a high-powered committee to study its investment objectives, policy and guidelines as it eyes higher returns on its nearly Rs 31 lakh crore corpus based on contribution from over 30 crore members. The issue was discussed at last week’s investment committee meeting, which was weighing the feasibility of investing in the equity markets beyond exchange traded funds (ETFs), tracking the benchmark NSE Nifty and BSE sensex indices. The panel, proposal for which came from a government representative, will see experts from multiple fields and government departments, a person who attended the meeting told TOI. According to its current investment pattern notified in April 2015, EPFO allocates 45-65% of fresh accretions to govt securities, while 20-45% goes towards investments in corporate debt papers, with up to 5% permitted to be allocated towards short-term debt instruments. That leaves around 5-15% of the flow for equities, via index funds. As of Dec 31, it had invested nearly 88% in government bonds and 10.6% in equities, officials said.

How’s your PF invested?

In the meeting, Crisil, which is the consultant, presented the feasibility of investing in emerging, sunrise sectors such as rare earths, railways and defence, along with examining yields of sectoral, factor and style-based indices. Some of the possible sectoral indices included those tracking banking and financial services, information technology, global indices, and FMCG. It also assessed indices that track momentum stocks, value stocks, and low volatility stocks. The retirement fund body is at work to increase its income as it is announcing significantly higher annual returns for its members than prevailing yields on government bonds in recent years, where most of its funds are parked. It is set to announce the interest rate for the current financial year next month. Last year, the RBI had suggested a series of measures to “improve” its investment management and accounting practices. It has appointed the IIM Kozhikode to examine its equity exit policy and the interest stabilization reserve. Besides, the investment panel also approved the proposal to introduce performance-linked incentives for its fund managers, wherein it will allocate greater funds to those who give better returns, as part of the new benchmark methodology for its debt investments. “The new benchmark methodology includes an accelerated negative marking provision for any fund manager who fails to meet it, which will adversely affect its portfolio allocation. The new methodology also discourages the fund managers from parking funds in low-yielding TREPS which are basically short-term, low-risk money market instruments,” the source added.