New Delhi: Prime Minister Narendra Modi on Wednsday Hailed The Next-Generation GST Reforms, which he said he said would improve the lives of citizens and ease of open Small traders and businesses.“During my independence day speech, I had spoken about our Internation to Bringing The Next-Generation Reforms in GST. The Union Government Had Prepared a Detailed A Detched Proposal For Broad-BESED GST RATE RAT REAT REFED Reforms, aimed at ease of living for the common man and strengthening the economy, “PM modi said.He further said: “Glad to state that GST council, comprising the union and the states, have collectively agreed to the proposals submitted by the union government on gst rate cuts & reforms, which benfiti Man, Farmers, MSMES, Middle-Class, Women and Youth. The wide-ringing reforms will improve lives of our citizens and ease of doing business for all, especially small traders and businesses.,

Finance Minister Nirmala Sitharan on Wednsday Announced Major Goods and Services Tax (GST) Rate Cuts, Saying that with the two-tier tax rate system approval, the Common Man will bested Greately. The GST council approved the two-tier rate structure of 5% and 18%.

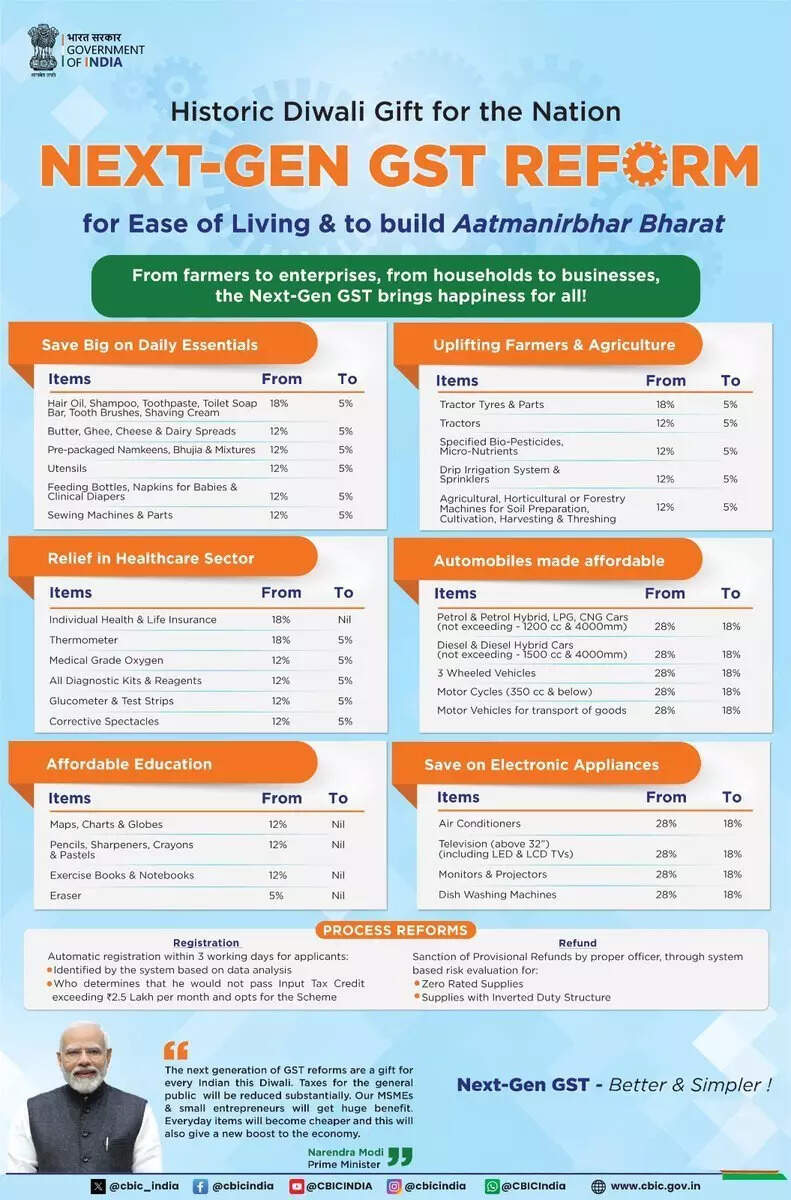

What Gets Cheaper?

The GST Rate Rate Rationalization will be implemented from September 22, according to a pti report. “For Common Man and Middle Class Items, There is a Complete Reduction from 18% and 12 to 5%. Items such as hair oil, toilet, soap bars, soap bars, shampoos, toothbrushes, tooth, tooth, tooth, toothpaste, toothpastes, Tableware, kitchenware and other household articles are now at 5%, “FM Sitharaman said. “Uht Milk, Paneer, All the Indian Breads will see nil rate,” She added. The 56th Goods and Services Tax (GST) COUNCIL Meeting Commented on Wednsday to Review Potential Rate Reductions and Category Adjustments for the Indirect Items Under the Indirect Taxes System.